Foreign investments remain steady

Brussels, January 16, 2024 – During the World Economic Forum, Flanders Investment & Trade (FIT) traditionally announces the investment figures for 2023: 265 new investment projects in Flanders, totaling €4.92 billion in investments and creating 4,596 jobs. This marks the third-highest investment figure ever, despite the backdrop of an international crisis. Foreign companies are primarily investing in innovative solutions, energy transition, pharmaceuticals, chemistry, and cleantech.

For Prime Minister Jan Jambon, who is traveling to Davos with the CEO of FIT, the investment figures are a recognition of the strengths of Flanders.

The investment figures for Flanders in 2023 in a nutshell

The current international economic climate is highly challenging. Nevertheless, foreign investments are holding up well, thanks to the strength of our ecosystem, high-quality workforce, innovative companies, and central location.

- Investment Amount - The announced investment amount is €4.92 billion. This represents the third-highest investment figure ever recorded.

- Number of Investment Projects - The number of investments also remains among the top 3 with 265 projects in recent years.

- Employment - Direct foreign investments contributed to the creation of 4,596 jobs in 2023, maintaining an average result over the years.

- Types of Companies - The investments are primarily in pharmaceuticals, chemistry, cleantech, and glass production. For instance, the German company Aurubis, a global leader in copper production and recycling, made two recent investments in Flanders. Additionally, the American company Plug Power, awarded "Foreign Investor of the Year" at the Flanders International Business Awards, is investing in a green hydrogen plant to establish a fundamental infrastructure for our green energy supply in the future. This investment aligns perfectly with the goal of a sustainable Flanders. Another example is the recent investment by the French company Fairbrics, propelling Flanders towards a circular carbon industry.

The investment figures for Flanders in 2023 in detail

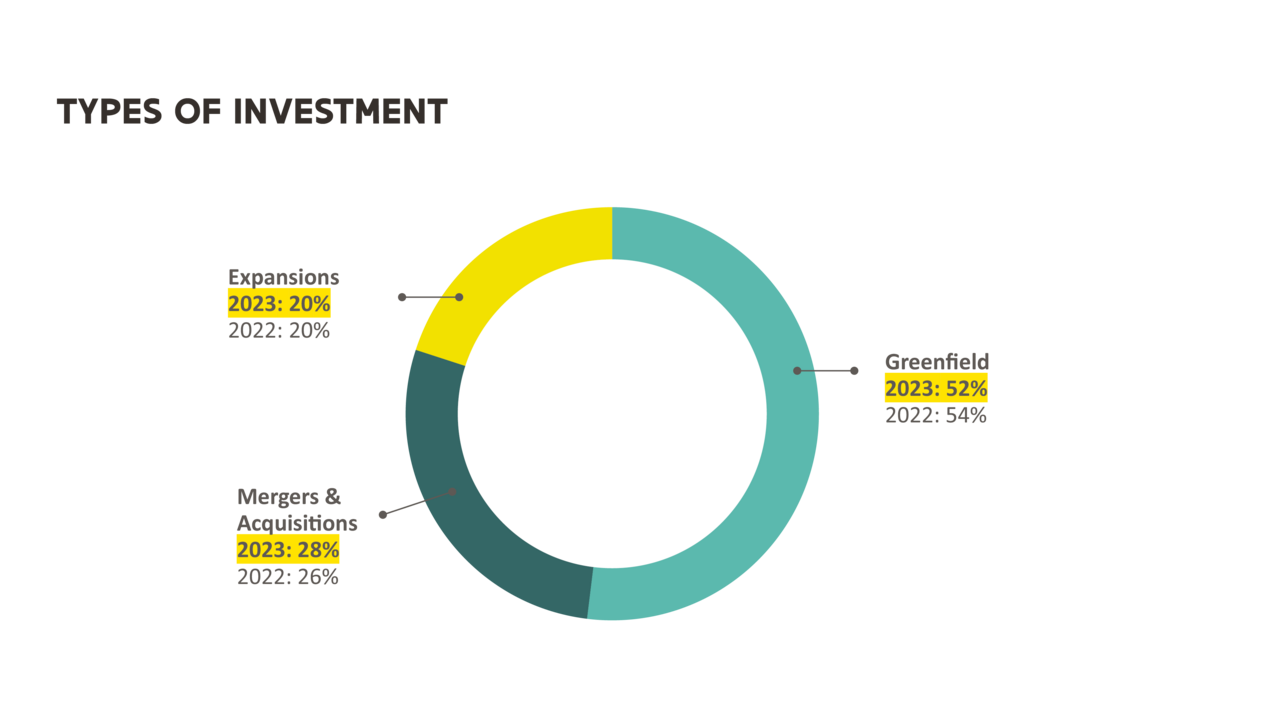

The majority of foreign investors opt for entirely new facilities in Flanders.

In 2023, the breakdown was as follows: 138 greenfield projects, 75 mergers & acquisitions, and 52 expansion projects.

The overall share of greenfields in 2023 continues to surpass the 50% mark (52.08%). One in two investments involves establishing a completely new facility. The share of expansion projects remains around 20% (19.62%). After a notable decline in the number of Mergers & Acquisitions in 2022, this category is now experiencing a slight increase: +2 projects.

When we examine the countries of origin of acquirers, these are primarily the neighboring countries and the United States. British investors also show a stronger presence after a decline last year. Remarkably, the Dutch exhibit significant activity, prominently leading this list. On the other hand, the United States appeared to be less active in the realm of Mergers & Acquisitions. China barely features in the Mergers & Acquisitions list.

Quality as the greatest asset with innovative solutions, energy transition, pharmaceuticals, chemistry, cleantech

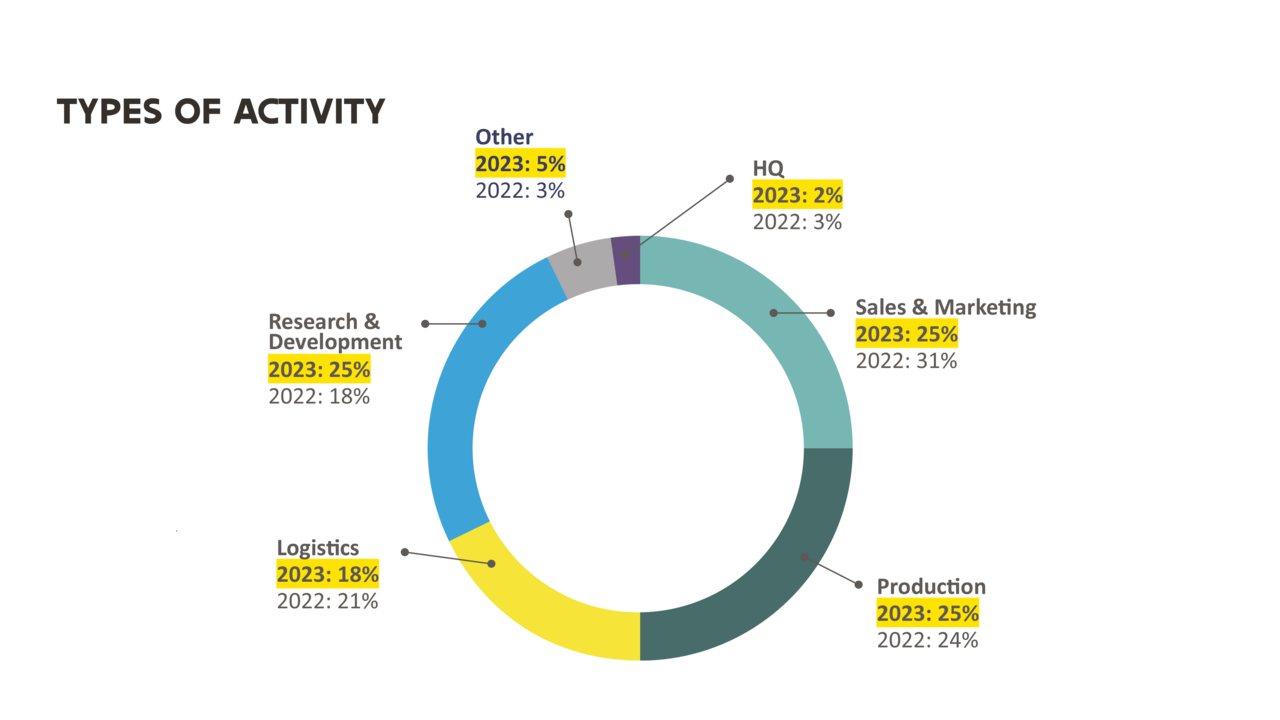

Flanders attracts a substantial number of foreign investments in strategic domains, primarily linked to production and R&D activities. For example, R&D activities increase from 18% to 25%, a significant boost for Flanders' ambitions as an innovative region. In terms of production, various pharmaceutical and chemical projects propel the investments forward. Additionally, investments focusing on climate technology and energy transition maintain a significant share.

Employment from direct investments normalizes after two peak years

After two consecutive years of growth, with a record year in 2022, there is a decline in the number of new jobs across all activities in 2023.

The Research & Development category, after years of strong growth, experiences a reversal. Only 241 new jobs were announced in 2023. We observe fewer hirings, particularly in research-driven consultancy, and the pressure on benefits for software development could be a possible explanation. Despite the increasing share of investments in R&D (from 18% to 25%), the number of new jobs decreases due to a large number of relatively small-scale projects and the fact that about half of the R&D projects in 2023 were carried out through acquisitions. Employment figures for acquisitions are never counted as it would lead to significant distortions.

Logistic activities have been on a declining trend for several years, with 1363 new jobs, falling below the threshold of 1500 for the first time in a while.

Encouragingly, employment figures for production activities, after peaking in 2022, remain strong. With 2,162 jobs and a share of 47.04%, industrial production remains clearly the largest job creator. This job growth is primarily driven by the pharmaceutical, automotive, cleantech, and glass production sectors.

Europe is a stronghold: the Netherlands leads the ranking

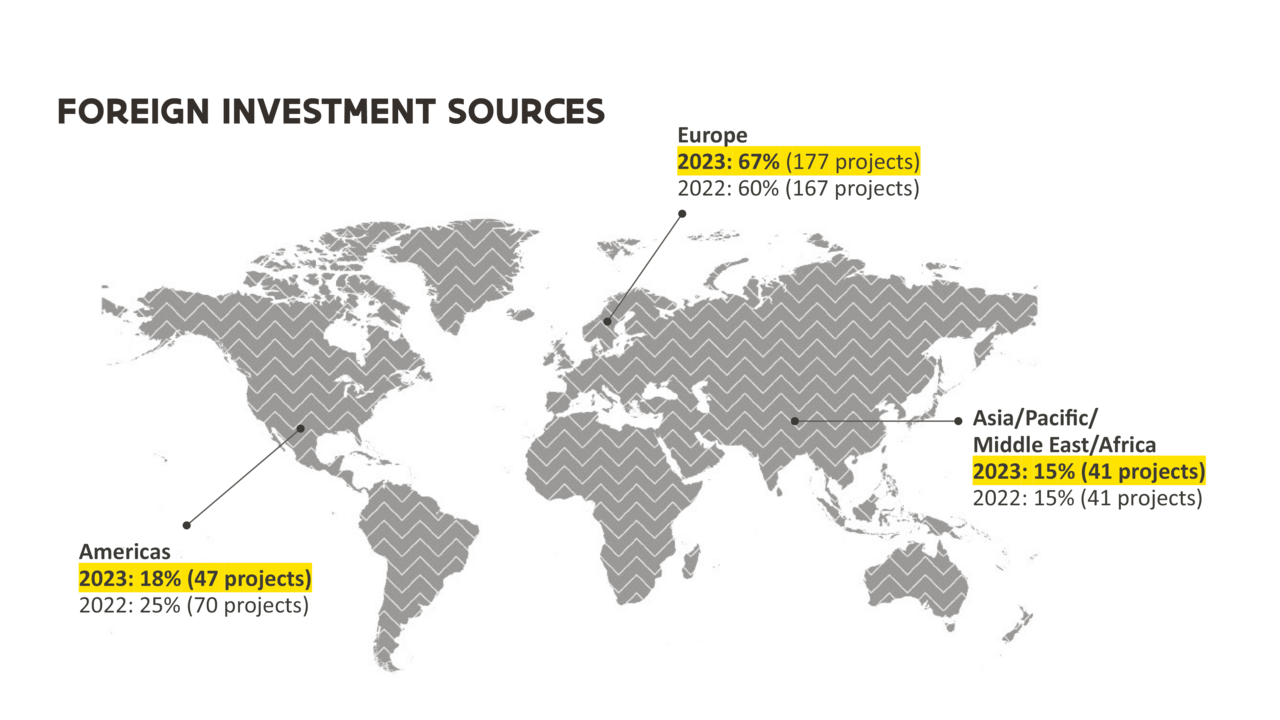

The comeback of the American continent, initiated in 2021 and leading to substantial employment growth in 2022, has come to an abrupt end. While the number of projects fell from 70 to 47, employment creation plummeted from 2870 jobs in 2022 to 446 jobs in 2023; a decline to one-sixth of the previous year's number. Signs of the impact of the American Inflation Reduction Act are evident.

This trend is clear when we look at the percentages of the share of North and South America in the total figures: in terms of the number of investments, they fall below the 20% threshold at 17.74% (in 2022: 25.18%), and in terms of employment, the share is less than 10% at 9.70%. In 2022, it was 43.88%.

This sharply contrasts with European investments, which experience not only a slight increase in the number of projects but a significant resurgence in employment. It seems that the decline last year was likely a temporary setback. 2023 is heading back towards the numbers of the years before.

Europe remains more than ever the stronghold of foreign investments, with a share of around 70% in both the number of investments (66.79%) and employment (72.06%).

Asian investments, after a few challenging Covid years, remain at the same level as last year, but employment sees a decline: from 1283 to 838.

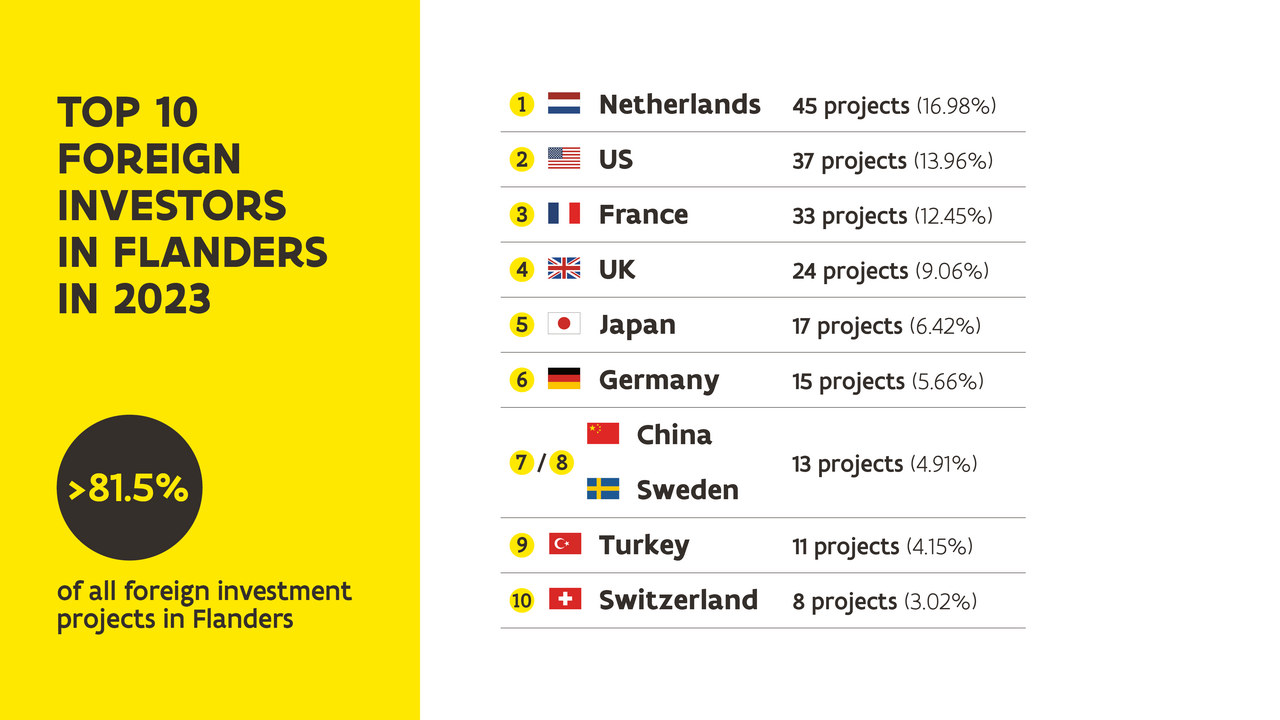

Although we find the familiar countries of origin in the top of the ranking again this year, namely the United States, our neighboring countries, the Asian countries China and Japan, and Sweden, 2023 is characterized by some noteworthy changes in the top 5.

- The Netherlands leads the ranking with 45 investments, surpassing the traditionally leading United States. The number one position is influenced both by the weaker performance of the U.S. and the increased merger and acquisition activities from the Netherlands (21 transactions).

- The United States, historically our most significant FDI origin, falls to second place. President Biden's generous support program (Inflation Reduction Act) likely reduces American interest in foreign ventures.

- France remains firmly in third place and experiences an increase in the number of projects: 33 compared to 31 in 2022.

- British investments maintain a solid fourth place. The number of projects has increased from 22 to 24, indicating that the UK, after the push in recent years via Brexit, remains a substantial source of investments.

- Japan has been steadily rising in recent years and enters the top 5 in 2023, displacing Germany from the rankings. With 17 projects (compared to 15 the previous year) for Japan, it seems that the challenging Covid years are definitively over.

Germany, which was consistently a mainstay in the top 5, remains below par with 15 projects. This might be a sign that the German engine is struggling in a challenging European context. Turkey is also a notable newcomer, surpassing 10 projects for the first time.