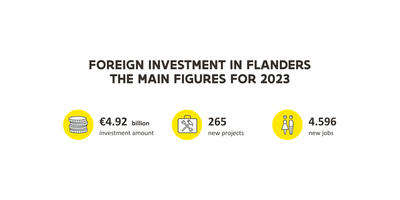

Flanders, your pocket-size hub for big business

It’s not about size. Proximity is the X factor for commercial and innovative success in Flanders, the northern region of Belgium. Discover all the ingredients for a fruitful outcome within arm’s reach.

Business Environment

Handbook to growing your business in Flanders

- Get an overview on all incentives relevant to your company.

- Tax system explained in-depth.

- Learn how to set up your business quickly.

- Discover the benefits of Flanders (in addition to the chocolate).