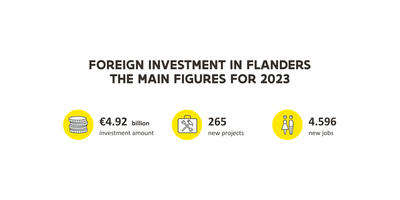

Foreign investments remain steady

16 January 2024

During the World Economic Forum, Flanders Investment & Trade (FIT) traditionally announces the investment figures for 2023: 265 new investment projects in Flanders, totaling €4.92 billion in investments and creating 4,596 jobs. This marks the third-highest investment figure ever, despite the backdrop of an international crisis. Foreign companies are primarily investing in innovative solutions, energy transition, pharmaceuticals, chemistry, and cleantech.